- Dapatkan link

- X

- Aplikasi Lainnya

Learn more about the differences between MoneyGuard II III and Lincolns timeline as they phase out MoneyGuard II below. Lincoln MoneyGuard III Get the full picture and.

Extensive Lincoln Moneyguard Review And Rating Long Term Care Insurance

Lincoln MoneyGuard III complies with principle-based reserving PBR2017 CSO Mortality Table regulatory adopted by the NAIC.

Lincoln moneyguard iii. 4 International benefits only apply to care received in a. Lincoln Money Guard III will pay for individuals such as friends family or whoever you elect tp plan for your care. Lincoln MoneyGuard III complies with principle-based reserving PBR2017 CSO Mortality Table regulatory adopted by the NAIC.

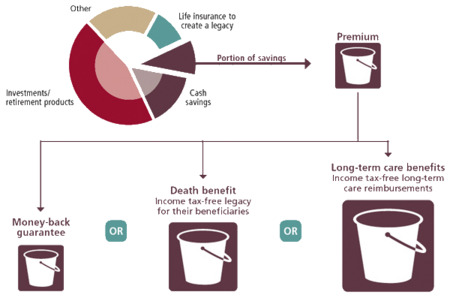

What we are doing Added simplicity More flexibility New New Updated Single rider design. Lincoln MoneyGuard III Hybrid Long Term Care Insurance product will pay a monthly benefit for home health care assisted living facility adult day care or nursing home care. It uses income tax-free long-lasting care benefits legacy protection and adaptability so you might feel confident knowing that youre prepared whatever life brings.

Lincoln MoneyGuard III offers accountability for care. 3 Available for an additional cost. Lincoln MoneyGuard III is a flexible premium universal life insurance product that provides a death benefit and long-term care LTC coverage through a policy rider.

Effective June 14 2021 we will be introducing the Flexible Care Cash Amendment to the Transitional Care Assistance Benefit on Lincoln MoneyGuard III. Lincoln MoneyGuard III Fact sheet Universal life insurance policy with a long-term care rider that reimburses for qualified long-term care expenses. 1 Lincoln MoneyGuard III is a universal life insurance policy with a long-term care rider.

There will be no pricing increases as a result of this update. Plus we allow direct billing to the care provider. Lincoln MoneyGuard III is a universal life insurance policy with a Long-Term Care Benefits Rider LTCBR that accelerates the specified amount of death benefit to pay for covered long-term care expenses and continues long-term care benefit payments after the entire specified amount of death benefit has been paid.

Following a transition period Lincoln MoneyGuard III will replace currently sold Lincoln MoneyGuard II 2019 in all approved states. MoneyGuard III is a simple powerful alternative solution that is created to meet your evolving requirements. To be eligible for your coverage Lincoln Moneyguard III has the exact same benefit triggers as all.

Lincoln MoneyGuard III Lincoln MoneyGuard II and Lincoln MoneyGuard II NY which will improve competitive pricing in key cells. Lincoln Money Guard III will cover the costs of nursing home care if needed. Benefits are paid by reimbursement of expenses ensuring funds for long-term care expenses are disbursed as needed.

Product features and benefits Issue ages and classes Ages 3070 age last birthday malefemale couples discount standard. This amendment provides clients additional benefit flexibility with access to receipt-free cash to help cover informal care needs at home including the opportunity for a spouse to provide the care. Effective June 14 2021 we will be introducing the Flexible Care Cash Amendment to the Transitional Care Assistance Benefit on Lincoln MoneyGuard III.

This Hybrid Long-Term Care Life Insurance policy provides three benefits to you the insured. Lincoln Financial launched the next generation of their Hybrid Long Term Care Insurance product called Lincoln MoneyGuard III launched in late 2019 and updated with new rates in June 2020. With Lincoln Money Guard III.

Lincoln MoneyGuard III is a universal life insurance policy with a qualified long-term care insurance rider. How Does Lincoln MoneyGuard III Work. Product pricing updates Lincoln MoneyGuard III 5-year LTC benefit duration with 3 inflation option design for issue ages 55-65 will see the.

Lincoln Moneyguard III is a universal life insurance policy with a long term care benefits rider LTCBR that will reimburse you for your qualified long term care expenses. 2 Long-term care reimbursements are generally income tax-free under IRC Section 104a3. Lincoln Moneyguard III is one of a handful of hybrid long term care insurance policy solutions for you to consider reviewing today.

Following a transition period Lincoln MoneyGuard III will replace currently sold Lincoln MoneyGuard II 2019 in all approved. Planning ahead with Lincoln MoneyGuard II gives you flexible options beginning at age 40. Other highly rated hybrid long term care policies for you to to consider will be OneAmerica Asset Care Securian SecureCare Nationwide CareMatters II and Pacific Life PremierCare.

Lincoln MoneyGuard II Like many people you want to help protect your retirement savings from health-related expenses such as long-term care. The Long-Term Care Benefits Rider LTCBR is a single rider design rather than separate riders for Acceleration and Extension which. On September 16th Lincoln Financial rolled out their new MoneyGuard III product.

Marketing Resources Education Issue

Lincoln Financial Long Term Care Insurance Reviews Retirement Living

Is Lincoln Moneyguard Worth Buying Today 2021 Review Long Term Care Insurance

Lincoln Moneyguard Iii Hybrid Life And Long Term Care Insurance Review Long Term Care University 04 01 21 Skloff Financial Group

How Does Lincoln Moneyguard Iii Hold Up In 2020

Lincoln Moneyguard Iii Hybrid Combination Life And Long Term Care Insurance Review Long Term Care University 09 16 19 Skloff Financial Group

Https Www Lfg Com Wcs Static Pdf Mgavailabilitygrid Pdf

Nationwide Carematters Review See How It Compares Today

How Does Lincoln Moneyguard Iii Hold Up In 2020

Lincoln Financial Hybrid Long Term Care Insurance Ltc News

Https Fulfillment Lfg Com Servepdf Aspx Sku Mgr Ca Fli058

How Does Lincoln Moneyguard Iii Hold Up In 2020

Lincoln Moneyguard Iii Hybrid Long Term Care Insurance Hybrid Long Term Care Plans

Is Lincoln Moneyguard Worth Buying Today 2021 Review Long Term Care Insurance

Lincoln Moneyguard Iii Hybrid Life And Long Term Care Insurance Review Long Term Care University 04 01 21 Skloff Financial Group

Considering Lincoln Moneyguard Read Our Review Now 2021

How Does Lincoln Moneyguard Iii Hold Up In 2020

Komentar

Posting Komentar